Texas Guide to New Construction Appraisals

- scott shipp

- Nov 29, 2025

- 12 min read

Building your dream home in places like Granbury or Weatherford is an exciting journey, but the appraisal process can feel like a major hurdle. An appraisal for new construction is different from one for an existing house. It’s all about determining your home's future "as-completed" value before the first wall ever goes up. This valuation is the key that unlocks your construction loan.

What a New Construction Appraisal Really Means

Think of it as a professional forecast of your home's future market value. For families building on a rural lot in Glen Rose or retirees planning a custom home in Stephenville, this is a critical step. The appraiser isn't focused on what your land is worth today; they are projecting what your finished home will be worth once construction is complete.

The appraiser's job is to provide an independent, professional opinion of that future value based on your specific plans. This "as-completed" value gives your lender confidence that the money they are lending is a secure investment backed by a real, valuable asset.

Why This Process Is So Different

Appraising something that doesn't exist yet presents a unique challenge. An appraiser can’t walk through the living room or inspect the kitchen cabinets. Instead, they must act as a detective, piecing together the home's value from a detailed set of documents you and your builder provide.

Here’s how this process differs from a standard appraisal:

It's a Forward-Looking Value: The entire valuation rests on a "hypothetical condition"—the professional assumption that the house will be built exactly as detailed in your plans.

It's Heavily Document-Dependent: The outcome leans almost entirely on the quality of your architectural drawings, material specifications (the "spec sheet"), and the builder’s contract.

Market Benchmarking is Key: The appraiser must find comparable sales of other new or recently built homes in your area. This can be tricky in the rapidly developing neighborhoods across North Texas where the market is always evolving.

An appraisal for new construction is less about inspecting a physical structure and more about evaluating a detailed vision on paper. The more complete your documentation is, the more accurate—and hopefully favorable—the outcome will be.

Ultimately, this step protects everyone involved, including you. It's an independent confirmation that the money being poured into construction is creating real, tangible value. A solid appraisal is the first major milestone that turns your dream home from a set of plans into a fully funded project.

Gathering Your Essential Appraisal Documents

When it comes to a new construction appraisal, the paperwork you provide is everything. Think of it as building a case for your home's future value—the more detailed and organized your evidence, the stronger your position. A complete document package is the single best way to sidestep delays and prevent a disappointing valuation.

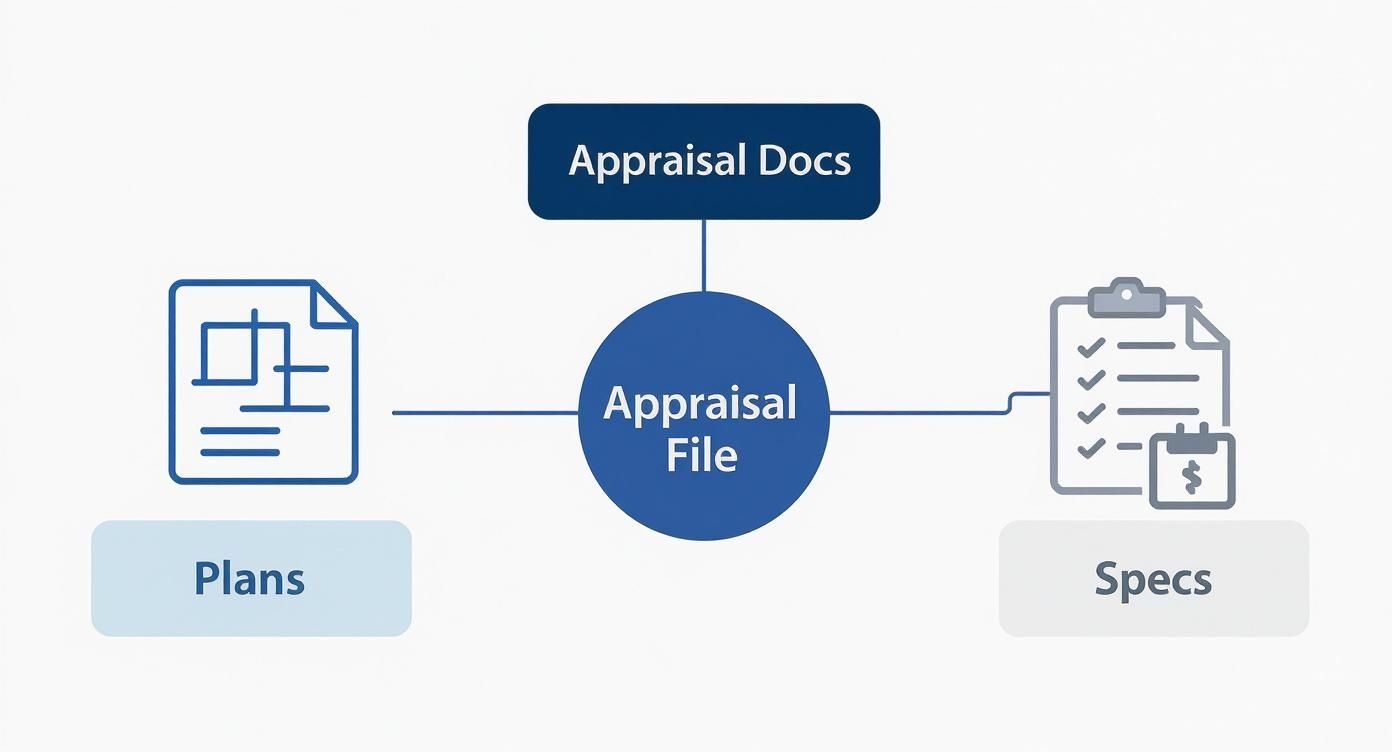

The goal is to give the appraiser a crystal-clear vision of the finished home. Since they can't walk through a completed house, they must rely entirely on the plans and specifications you and your builder pull together. A well-organized file shows them your project is meticulously planned, uses quality materials, and represents a sound investment for the lender.

Your Document Checklist

To get this right, you'll need to assemble a comprehensive file. Every document helps the appraiser connect the dots, visualize the final product, and justify the numbers. Here’s a rundown of the must-haves for any new build in North Texas.

This table outlines the key documents and explains why each one is so important for arriving at an accurate valuation.

Essential Documents for Your New Construction Appraisal

Document Type | What It Is | Why It's Critical |

|---|---|---|

Complete Architectural Plans | The full blueprints, including floor plans, all exterior elevations, and a site plan showing the home's placement on the lot. | This is the visual foundation. It shows the home's size, layout, and unique design features. |

Property Survey | A legal document mapping out the precise boundaries of your land, easements, and any topographical details of the property. | The survey confirms the legal description of the land and any restrictions, which is fundamental to its value. |

Signed Construction Contract | The official, legally binding agreement detailing the scope of work, total cost, and responsibilities for you and the builder. | This proves to the lender and appraiser that there is a firm agreement in place to build the home for a specific cost. |

Builder's Detailed Cost Breakdown | An itemized list of all project expenses, from the foundation and framing materials to individual labor costs. | This is the primary tool the appraiser uses for the Cost Approach, which is especially critical for custom homes. |

Schedule of Materials (Spec Sheet) | A detailed list specifying every finish and fixture—brand names, model numbers, materials, colors, and quality levels. | This is where the true quality (and value) is shown. It allows the appraiser to give you credit for premium choices. |

Putting this package together properly is the best thing you can do to help your appraiser see the full value of the home you're building.

The Power Is in the Details: Your Spec Sheet

If one document can make or break your appraisal, it’s the Schedule of Materials, often called the "spec sheet." This is where you move beyond generic descriptions and get into the specific, value-adding details that set your home apart.

An appraiser can’t give you much credit for "wood floors." But they absolutely can—and will—for "3/4-inch solid Hickory hardwood flooring." Specificity is your best friend.

Your spec sheet is your chance to paint a vivid picture of quality. Every detail matters. For instance, instead of just listing "sod," a savvy North Texas builder would specify "drought-tolerant Zoysia grass sod"—a practical, high-quality choice for our hot Texas summers that a local appraiser will recognize and value. A great spec sheet for a family home in Granbury might call out practical, durable finishes like Level 3 quartz countertops that stand up to daily life.

A strong spec sheet will spell out:

Specific Brands and Models: List the exact make and model for all appliances, the HVAC system, windows, and even plumbing fixtures.

Material Quality and Grade: Note the type of stone for your countertops (e.g., "Level 3 Quartz"), the specific brand of roofing shingles, and the grade of framing lumber.

Energy-Efficient Features: Be sure to call out any high-performance windows, upgraded spray foam insulation, or high-SEER HVAC systems that add to the home's long-term value and efficiency.

Compiling all this information is a key step in the overall home-building journey. To see how this fits into the bigger picture, check out our homeowner's guide to the construction timeline.

How Appraisers Determine Your New Home's Value

Ever wonder how an appraiser lands on that final number? It’s not a gut feeling. They act as financial detectives, using established, data-backed methods to determine a property's "as-completed" value.

For new construction here in North Texas, especially in areas like Aledo and Tolar, they lean heavily on two primary techniques. Understanding these methods pulls back the curtain on the process and helps you see your project from their perspective. Often, they’ll use both to paint the most accurate picture of your home’s worth.

The Sales Comparison Approach

This is the bread and butter of residential appraisals. The Sales Comparison Approach is exactly what it sounds like—the appraiser compares your future home to similar new homes that have recently sold nearby. These are known in the industry as "comparables" or "comps."

They hunt for properties that mirror yours in key areas:

Size and layout, like another 2,500 sq ft, 4-bedroom house.

Lot characteristics, such as the acreage of a rural property in Granbury.

Construction quality and finishes—are we talking builder-grade or high-end custom?

Overall style and amenities like pools, outdoor kitchens, or extra garage space.

Of course, no two homes are identical, and that's where adjustments come in. If a comp sold for $550,000 but had a three-car garage and your plans only have a two-car, the appraiser will adjust that comp’s price downward to make the comparison fair. After making these tweaks to a few solid comps, a clear market value for your home starts to emerge.

This is where all your documentation—the plans, specs, and contract—becomes absolutely essential.

As you can see, those core documents are the evidence they use to find the right comps and make the most accurate adjustments.

The Cost Approach

While comparing sales is standard, the Cost Approach often takes center stage for custom homes. This is particularly true for unique builds on rural land in places like Glen Rose or Weatherford, where finding a truly comparable sale can be nearly impossible.

This method is like building the house on paper and totaling the receipts.

The formula is logical:

Value of the Land: What is the empty lot worth on its own?

Cost to Build: What would it cost to build your exact home from the ground up today? This includes all materials, labor, fees, and the builder's profit. Your detailed cost breakdown is the key piece of evidence here.

Subtract Depreciation: For a brand-new home, depreciation is typically zero. This is what makes the Cost Approach so reliable for new construction.

The Cost Approach boils down to one simple question: "What would it cost someone today to buy this piece of land and replicate this exact house?" For one-of-a-kind custom homes, this is often the most logical way to establish value.

In the end, the appraiser will look at the values from both the Sales Comparison and Cost approaches and "reconcile" them into a final opinion of value, giving more weight to the method that makes the most sense for your property.

Grasping these two methods is a major step in understanding how to build a custom home in North Texas and moving through the process with confidence.

Key Factors That Influence Appraisal Value

When an appraiser reviews your plans, they're doing more than ticking boxes. They're figuring out what your home will truly be worth once it's finished. Understanding what they focus on is the key to making smart decisions with your builder—choices that directly boost your home's final value.

It boils down to a mix of the big picture and the small details. Appraisers look at your project through the eyes of a potential buyer in your specific North Texas market, from the rolling hills of Glen Rose to growing communities like Weatherford. They're constantly asking, "What would a savvy buyer pay for this home, right here, right now?"

Let's pull back the curtain on what really moves the needle.

Location and Lot Characteristics

It's the oldest rule in real estate for a reason: location is everything. An appraiser digs deep into the specifics of your lot and the surrounding area.

Neighborhood Appeal: Is your property zoned for a top-tier school district like Aledo or Granbury ISD? Proximity to shops, parks, and the character of the neighborhood all play a huge part.

Site Specifics: Especially for rural builds, not all acreage is created equal. An appraiser notes road frontage, the slope of the land, and how much of it is usable. A five-acre lot that's mostly steep and rocky is valued very differently than five flat, buildable acres with mature oak trees.

Quality of Construction and Finishes

This is where your detailed spec sheet becomes your most valuable asset. An appraiser can't give you credit for high-end materials if they aren't clearly documented.

For example, a standard, builder-grade appliance package might add $3,000 to the value. But a documented, premium brand package could easily add $12,000 or more. The same goes for your countertops, flooring, windows, and light fixtures. Every upgrade matters, but only if it's on paper.

Here in North Texas, appraisers know what buyers want. Features that help beat the heat and make outdoor living enjoyable are highly valued. Energy-efficient windows, spray foam insulation, and a large covered patio aren't just perks—they are real, tangible assets that add to your bottom line.

Floor Plan and Functional Design

A home’s layout has to make sense for how people live today. An appraiser is looking at the flow and functionality of your floor plan, judging it against what’s popular with buyers in Hood and Parker County.

Desirable Layouts: Open-concept living spaces are still king. Other high-demand features include split-bedroom designs (where the master suite is separate for privacy) and dedicated home offices, a must-have for many families.

Bed and Bath Count: This is a fundamental driver of value. A four-bedroom home will almost always appraise higher than a three-bedroom of the same size and quality in the same neighborhood.

Unique Structures: Even the design of less common builds, like a barndominium, is judged on its functionality. If you're considering this popular style, our guide to building a barndominium in North Texas is a great resource for understanding its unique value points.

Appraisers also consider the broader economic climate. The Q2 2025 RICS Global Construction Monitor notes that while residential sentiment is flattening in some regions, construction costs continue to climb. This environment makes it even more critical for your appraisal for new construction to reflect features with a proven return on investment in our local market.

Avoiding Common New Construction Appraisal Pitfalls

A low appraisal can feel like a storm cloud rolling in, threatening to stop your project cold. But the truth is, most appraisal issues don't just appear out of thin air; they often stem from a few common, avoidable missteps.

Knowing where the landmines are allows you and your builder to create a smart playbook to protect your home's value right from the start.

So, where do things usually go wrong? Often, it’s a simple communication breakdown. An appraiser can't value what they don't know about, so a vague spec sheet is a classic culprit. Another frequent issue is a builder's cost estimate that's out of sync with what the local market in places like Granbury or Weatherford will actually support.

Proactive Strategies for a Successful Appraisal

The best way to handle the appraisal is to get ahead of it. Don't just cross your fingers and wait for the report. You and your builder can take concrete steps to ensure the appraiser sees the full, accurate value of what you're creating.

Here are a few practical strategies to discuss with your builder:

Provide Builder Comps: Ask your builder to pull together a list of similar homes they've recently finished nearby. This isn't about telling the appraiser how to do their job; it's about providing a helpful starting point with relevant, high-quality examples they might not easily find.

Be Available for the Site Visit: Your builder should be on-site to answer questions. They can point out things not obvious on a blueprint, like upgraded spray foam insulation behind the drywall or pre-wiring for a future outdoor kitchen. These details add real value.

Highlight Unique Lot Features: Does your rural property in Glen Rose have a great view, mature oak trees, or creek frontage? Make sure someone points that out. These are unique assets that directly boost the land's value.

Avoiding Costly Oversights

Sometimes, the choices we love most can hurt us in an appraisal. That quirky, ultra-modern floor plan might be perfect for your family, but it can lack the broad market appeal appraisers are trained to look for. They must value a home based on what a "typical" buyer in the North Texas market would pay.

A critical pitfall is failing to align the project's scope with the current market. We're in a tricky environment where interest rates and rising contractor costs are putting pressure on valuations. What a home might have appraised for two years ago isn't guaranteed today.

The entire construction world is navigating choppy waters. After a period of intense growth, projections are cooling off, which makes a solid, well-supported appraisal more critical than ever. For a better sense of the big picture, you can explore a deeper dive into these construction market trends.

In the end, a successful appraisal comes down to three things: crystal-clear documentation, proactive communication, and smart design choices that respect the local market.

What to Do If Your Appraisal Comes In Low

Getting the news that your appraisal came in low can feel like a punch to the gut. It’s frustrating, but it’s far from the end of the line. This is a common hurdle in the custom home world, and there’s a clear path forward if you stay calm and methodical.

Your first step is to ask your lender for a complete copy of the appraisal report. Sit down with your builder and go through it line by line. You’re looking for honest mistakes. Appraisers are human, after all. Perhaps they recorded the wrong square footage, missed a bathroom, or didn’t include a significant upgrade.

Challenging the Valuation

If you spot errors or feel the appraiser missed the mark, you can file for a "Reconsideration of Value." This isn’t a simple complaint; it’s a formal appeal where you present hard evidence to argue for a higher valuation. Just saying "I disagree" won't get you anywhere—you have to build a case.

Your challenge needs to be rooted in data. This is where a great partnership with your builder is crucial. Work together to find better comparable sales that the appraiser might have overlooked. For example, maybe a nearly identical custom home sold recently just outside the appraiser’s search radius in a neighboring Granbury community. Supplying these “better comps” is the single most powerful tool you have.

Exploring Your Other Options

If a reconsideration doesn’t work, you still have a few solid options. It’s a good time to sit down with your family, builder, and lender to talk through the trade-offs of each.

Bring More Cash to Closing: This is the most straightforward fix. You simply pay the "appraisal gap"—the difference between the appraised value and what your home costs to build—out of pocket.

Renegotiate with Your Builder: A good builder is a partner. Have an honest conversation about the numbers. Is there room to renegotiate certain costs or find savings elsewhere without compromising quality? For example, could a different brand of tile achieve the same look for less?

Seek a Second Opinion: You can always apply with a different lender, which will trigger a new appraisal. It adds time and expense with no guarantees, but a fresh set of eyes might arrive at a different number.

A low appraisal on a new construction project feels like a major roadblock, but it's a solvable problem. It just takes patience, clear communication with your builder, and a willingness to explore every financial and negotiation strategy available.

It's also worth remembering that the wider real estate market plays a big part. While forecasts for 2025 show North America has a promising real estate growth projection of 13%, we're also facing higher building costs. Appraisals have to walk a fine line, balancing strong regional demand with the real-world expenses of a new project. At its core, an appraisal for new construction must weigh what the home costs to build against what the market is willing to pay, a dynamic you can learn more about by exploring global real estate investment trends.

Building your dream home should be an exciting chapter, not a source of stress. If you're planning a project in the Granbury area, finding a builder who understands the appraisal process inside and out is non-negotiable. If you have questions about your project, our team is always happy to offer guidance. Visit us at https://www.geminihomesgranbury.com to see our work and learn how we help homeowners navigate every step of the build.

Comments