A Homeowner's Guide to North Texas Hail Damage Roof Insurance Claims

- scott shipp

- 3 days ago

- 16 min read

Once the hail stops pounding your roof, the clock starts ticking on your insurance claim. Here in North Texas, we know that what you do in those first few hours can make or break your entire claim experience. A calm head and a smart plan are your best assets for getting your home in Granbury or Weatherford put back together correctly.

What To Do Right After a North Texas Hailstorm Hits

The aftermath of a big hailstorm is chaotic. That deafening roar of ice hitting your home has finally stopped, and now you're left to figure out what just happened. Your first priority is to get a handle on the damage, but you have to do it safely.

First rule: stay off the roof. It’s likely wet, slippery, and you don’t yet know if there’s any structural damage. You can find plenty of evidence from the ground.

Conduct a Safe Ground-Level Inspection

Take a slow walk around your entire property. You're looking for the obvious and the not-so-obvious signs that hail came through. I had a client in Stephenville who first spotted dings on his garage door, which tipped him off to check everything else more closely. That's exactly the right way to do it.

Here’s a practical checklist of what to look for from the ground:

Gutters and Downspouts: These are often the first and clearest casualties. Check for dents and dings. If your aluminum gutters are beat up, it’s a sure sign your roof took a beating, too.

A/C Unit: Look at the thin metal fins on your outdoor air conditioner. They bend and dent very easily, giving you fantastic evidence of the hail’s size and force.

Siding, Windows, and Screens: Scan your siding for any chips, cracks, or holes. Check your window screens for tears and the surrounding trim for dents.

Fences and Decks: Hail can leave pockmarks or splinter wood surfaces. Look for fresh, unweathered impact spots on your stained deck or fence.

The point of this initial walk-around isn't to diagnose every single problem. It's to gather clear, immediate proof that a significant hail event happened right at your address. This is the bedrock of your insurance claim.

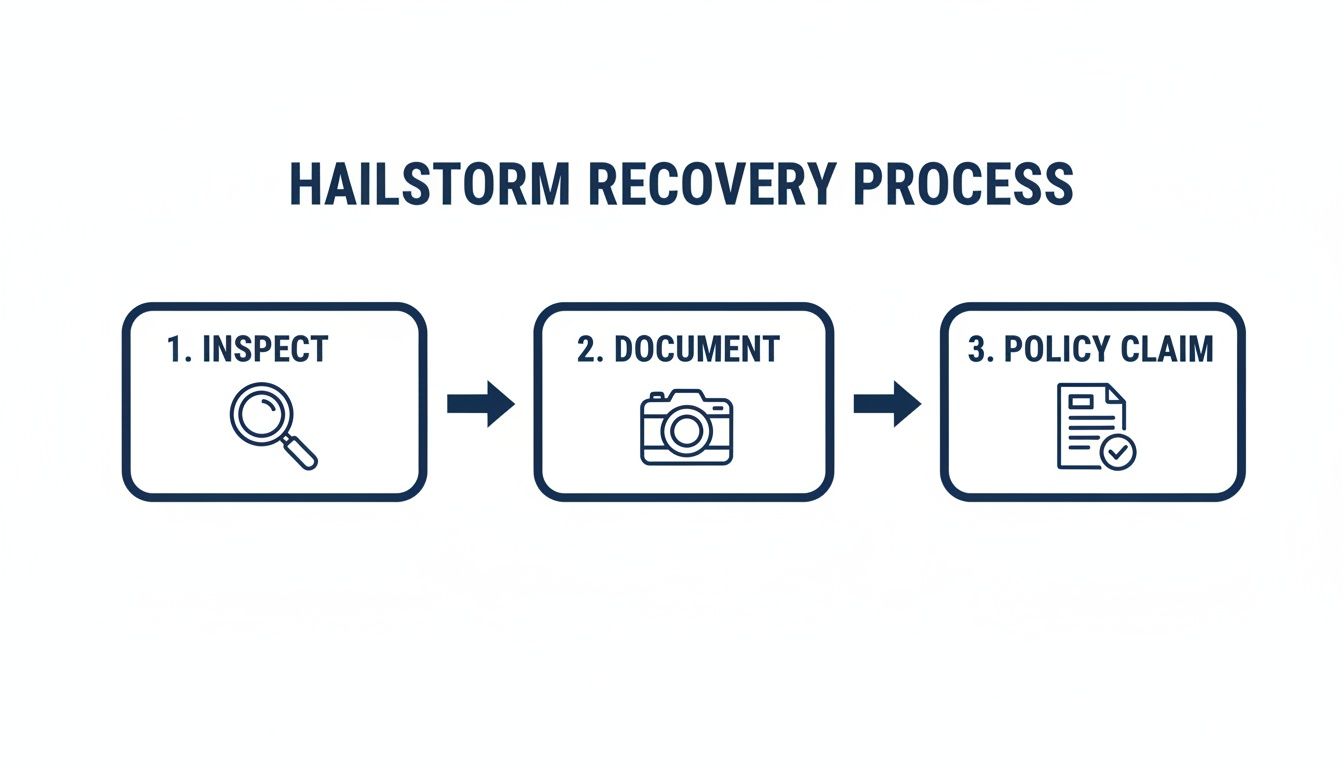

This simple process flow shows the critical first moves you need to make.

Following this sequence—inspect, document, review—ensures you're covering all your bases right from the start.

Document Everything Immediately

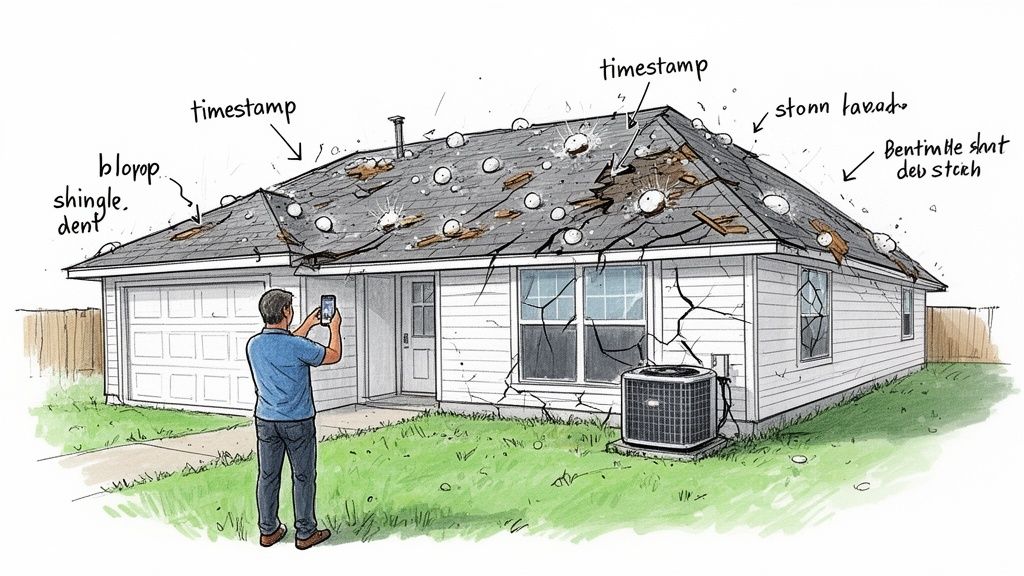

Before you clean up or move debris, pull out your smartphone and start taking pictures and videos. These timestamped files are your baseline—proof of what the storm did and when.

Get wide shots of each side of your house, then zoom in on the specific damage you found. If you see hailstones still on the ground, grab a quarter or a tape measure and place it next to them for scale before you snap a photo. This gives the insurance adjuster a real sense of the storm's power. This isn't just about the roof; it's about telling the full story of the storm's impact on your property.

Locate and Review Your Insurance Policy

Now it’s time to dig out your homeowner's insurance policy. Before you call your agent, you need to find two things: your policy number and your deductible amount.

Your deductible is what you'll pay out-of-pocket before the insurance money kicks in. Knowing this number upfront avoids any nasty surprises. If you want to learn more about the unique factors that affect homes in our area, check out our guide on building in North Texas.

Walking into that first call with your insurer armed with your policy number and an understanding of your deductible shows them you’re prepared and changes the dynamic, turning a stressful call into a productive first step.

Building an Undeniable Hail Damage Claim

After a big hailstorm blows through Granbury or Weatherford, a successful hail damage roof insurance claim is built on a solid foundation of clear, organized evidence. Your job is to create a damage portfolio so thorough it leaves very little room for debate.

This process is about more than just snapping a few quick pictures. You're painting a complete picture of the storm's impact on your entire property, not just the shingles. This is how you help the adjuster understand the full scope of the loss, prevent lowball offers, and secure the funds you actually need to put your home back together correctly.

Mastering the Art of Photo Documentation

Your smartphone is your best friend right now. Insurers live by visual evidence, and great photos can make or break your claim. The trick is to capture everything from multiple angles, starting with the big picture and zooming in on the details.

Think like a storm damage investigator and document everything with a purpose:

Hail for Scale: Before it melts, place a quarter, a golf ball, or a tape measure next to some of the larger hailstones for a photo. This gives the insurance company an instant, undeniable reference for the storm's intensity.

Wide-Angle Shots: Stand back and take pictures of each side of your house and every slope of your roof. This establishes the scene and shows which areas took direct hits.

Mid-Range Photos: Get closer and capture entire sections of your roof, siding, and gutters. These shots are critical for showing the pattern and density of the impacts.

Close-Up Detail: Now, get right up on the individual "hits." Take clear, focused photos of the bruised, cracked, or dented shingles, busted-up flashing, and chipped siding.

The story you're telling is one of widespread, consistent damage. When an adjuster sees a high concentration of impacts across multiple surfaces, they are far more likely to approve a full replacement than if they only see a few isolated dings.

Don't Overlook Collateral Damage

Many homeowners, especially in rural areas around Glen Rose and Tolar, make the mistake of focusing only on the roof, leaving thousands of dollars on the table. Your policy covers your entire property, not just the house. Expanding your inspection strengthens your whole claim.

Make sure you check and photograph damage to these areas:

Outdoor Structures: Sheds, barns, detached garages, gazebos, and pergolas.

Fencing and Decks: Look for fresh pockmarks, splintering, or paint chips on wood, vinyl, and composite surfaces.

HVAC Units and Pool Equipment: Dented fins on an A/C condenser are some of the best, most undeniable proof of hail you can find.

Mailboxes and Light Fixtures: These metal and plastic surfaces show dings and cracks very clearly.

Documenting this "collateral damage" substantiates the storm's severity. It proves the hail was powerful enough to damage sturdy materials all over, making it much harder for an insurer to claim the roof damage is just normal wear and tear.

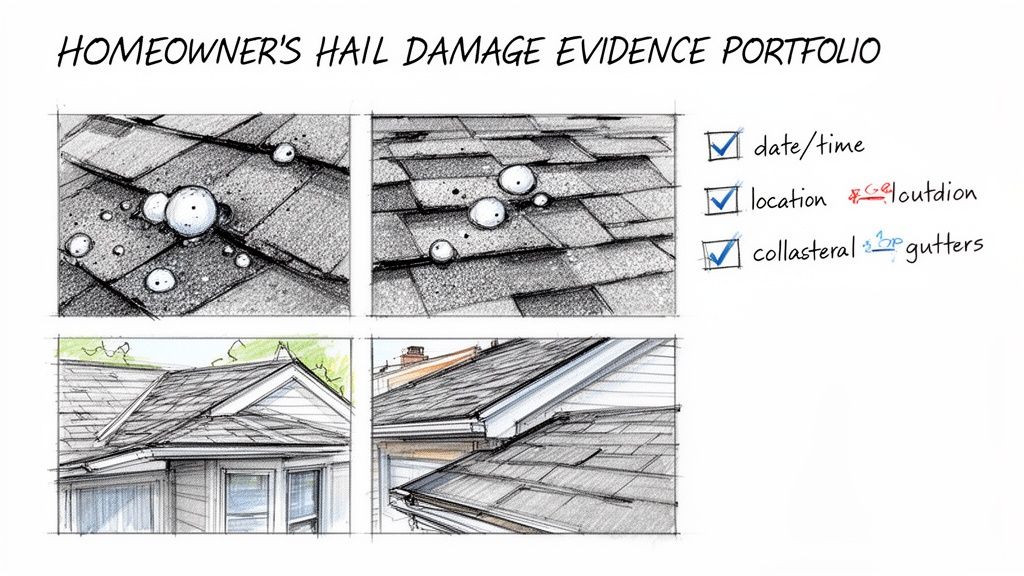

Create a Hail Damage Log

To keep everything organized and present a professional-looking claim, log every piece of evidence. A simple chart can help you track your photos and ensure you don't miss a thing when talking to your adjuster.

Your Hail Damage Evidence Checklist

Damaged Item (e.g., Roof Shingles, Gutter, Window Screen) | Location on Property (e.g., West-facing roof slope, Back deck) | Description of Damage (e.g., 15 dents per square foot, 3-inch crack) | Photo/Video Log Number |

|---|---|---|---|

Filling this out as you go creates a powerful, easy-to-follow summary of your losses that complements your photo library perfectly.

Your Written Record Is a Powerful Tool

Photos are vital, but your own written notes provide context. Grab a notebook or start a new note on your phone immediately after the storm. The more details you can record while they’re fresh in your mind, the more prepared you'll be.

Jot down the specifics of the event:

The date and approximate time the storm hit.

How long the hail actually lasted.

Your own observations—the size of the hailstones (e.g., "quarter-sized," "golf ball-sized") and the wind direction.

Any leaks or water spots you notice inside your home in the days that follow.

When you can confidently tell an adjuster, "The hail lasted for 15 minutes and was hitting the west side of our house so hard it sounded like a freight train," you're not just a claimant—you're a credible witness. This personal account, backed by your photo library, creates an undeniable story of your loss.

So, It's Time to File Your Insurance Claim

You've done the groundwork and gathered your evidence. Now comes the moment that can feel daunting: making the call to start your hail damage roof insurance claim. With your documentation in hand, you’re an informed partner ready to get things done.

The only goal of this first call is to get a claim number assigned. Keep it simple and stick to the facts. This isn't the time to guess at the full scope of the damage or offer theories that might be used against you later.

Making That First Call

When you dial your insurance company, have your policy number handy. A calm, matter-of-fact approach sets a professional tone for the entire process.

You can say something as straightforward as this:

"Hi, my name is [Your Name], and my policy number is [Your Policy Number]. Our home in Granbury was hit by a pretty bad hailstorm on [Date of Storm], and I need to open a claim for the damage."

They’ll take it from there and ask their standard questions. The most important thing you'll get is a claim number—write it down immediately and keep it somewhere safe. You'll need it for every conversation from here on out.

What to Ask Your Claims Rep

This initial call is your first chance to get clarity on what's coming next. Don't be shy about asking questions that will help you map out the road ahead.

Here are a few must-ask questions:

"What is my deductible for hail or wind damage?" It's not always the same as your standard deductible, so you need to know exactly what your out-of-pocket cost will be.

"When should I expect a call from an adjuster?" After a big North Texas storm, adjusters are slammed. Getting a rough timeline helps manage expectations.

"Do I have to use a specific contractor from a list?" Most of the time, the choice is yours, but it never hurts to confirm this upfront.

"What's the very next step in the process after we hang up?" This ensures you know exactly what you’re supposed to do next.

Getting a handle on the insurance maze is half the battle. If you're looking for a partner to guide you, you can learn more about how we help homeowners through the entire insurance claims process.

Understanding How You Get Paid: ACV vs. RCV

This is where things can get confusing. Most Texas policies are written for Replacement Cost Value (RCV), but it’s not a simple one-and-done check. You have to understand two critical terms:

Actual Cash Value (ACV): Think of this as the "used" value of your roof right before the storm. It’s the replacement cost minus depreciation for age and wear. This is the amount of the first check you'll get. For a 10-year-old roof with a 20-year lifespan, the ACV might only be about half the total cost to replace it.

Replacement Cost Value (RCV): This is the total amount it costs to put a brand new, similar-quality roof on your house at today's prices. The money held back—the difference between RCV and ACV—is called the depreciation.

You don't see that depreciation money until the job is done. Only after your contractor finishes the work and you submit the final invoice will the insurance company release the rest of the funds. For a family in a custom home in Stephenville, that held-back amount can easily be tens of thousands of dollars. It’s a huge point of confusion, so remember: you won't get the full amount upfront.

And the stakes are getting higher. Recently, U.S. roof repair and replacement claims hit nearly $31 billion, a massive 30% jump from prior years, with wind and hail being the main culprits. These storms now account for over 25% of all residential claim values. You can read more about these evolving roofing risks and their costs on Verisk.com.

Knowing these terms gives you the confidence to talk intelligently with your adjuster and your roofer, ensuring you get every penny you’re entitled to under your policy.

Working with Your Adjuster and a Local Roofing Pro

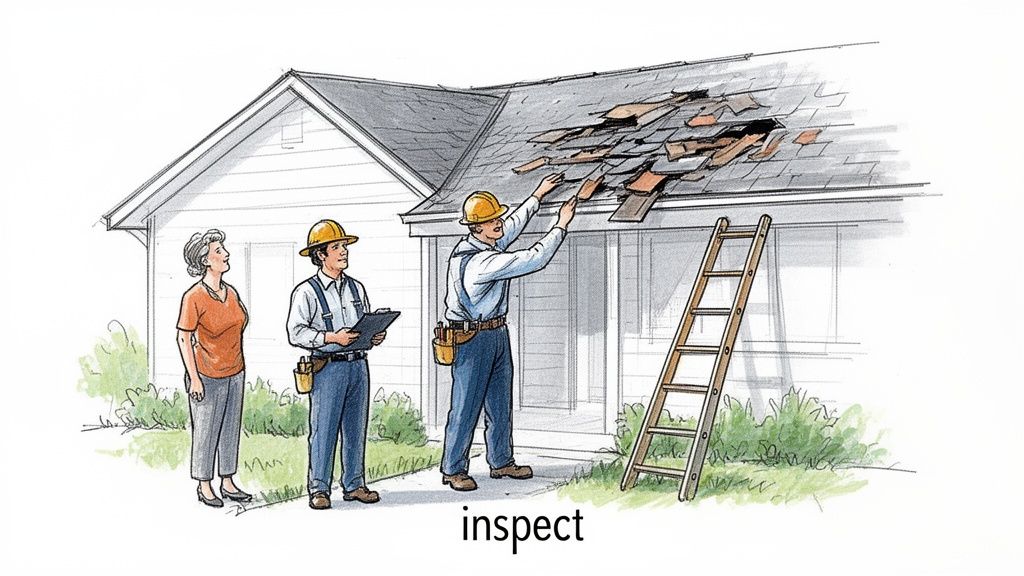

Once you file your claim, the adjuster's visit is the moment of truth. This inspection is where the official scope of damage is set and the initial payout is determined. Getting this meeting right—with the right expert in your corner—can be the difference between a smooth repair and a long, drawn-out fight.

This is exactly why we always tell homeowners to have a trusted, local roofing contractor present for the adjuster's inspection. It simply levels the playing field. Remember, the adjuster works for the insurance company; your roofer works for you.

Having both of them on your roof at the same time ensures every single dent, crack, and weak spot is seen and discussed. An adjuster might glance at scuffed-up flashing and call it cosmetic, but an experienced roofer can explain how that "minor" damage actually compromises the waterproofing, turning a small oversight into a major future leak.

Spotting Storm Chasers vs. Choosing a Local Pro

After a big hailstorm roars through North Texas, it's like clockwork: the out-of-state trucks roll in. These are "storm chasers," contractors who follow bad weather, knock on doors, and try to sign as many jobs as possible before skipping town. They’re notorious for high-pressure tactics and empty promises.

Keep an eye out for these tell-tale signs of a storm chaser:

They knock on your door uninvited with an aggressive, "sign now or the deal is gone" pitch.

They offer to "eat," "waive," or "cover" your deductible. This is illegal in Texas and a massive red flag for insurance fraud.

They can't provide a permanent, local business address or prove any real ties to the Granbury, Weatherford, or Stephenville communities.

They demand a large down payment before any materials have even been ordered.

A reputable local roofer is the complete opposite. They are part of your community, with a hard-earned reputation to protect. They’ll still be here years from now if you have a problem, and they know our local building codes and weather patterns inside and out. Take a look at some of our past remodeling projects to see the kind of craftsmanship you should expect.

Your home is your biggest investment. Don't hand it over to a contractor who has no investment in your community and will be a ghost by the next storm season. A local pro has every reason to get the job right.

What to Do with the Adjuster's Summary

After the inspection, you'll get a document from the insurance company, usually called an "adjuster's summary" or "scope of loss." This is an itemized list of every repair they've approved and what they think it will cost. You and your contractor need to go over this with a fine-tooth comb.

Don't panic if the initial estimate seems low—it often is. It's common for adjusters to miss things or use outdated pricing for labor and materials that don't reflect the current North Texas market. Your roofer can immediately spot the gaps between the adjuster's numbers and the real-world cost to do the job properly.

If you disagree with the assessment, you have every right to challenge it. Your contractor can submit their own detailed estimate to the insurer, complete with photos and a clear explanation for why certain repairs or a full replacement are necessary. This professional counter-offer becomes the starting point for negotiating a fair and complete settlement.

This is a critical step. Consider that hail damage claims make up 45.5% of all homeowners insurance claims in the U.S. and are the leading cause of roof destruction. With the average claim hitting $11,695 and Texas seeing annual hail losses between $8-15 billion, insurance companies are handling a huge volume. It's easy for details to get missed. You can learn more about the staggering impact of hail on property insurance from Cape Analytics.

Armed with your roofer's professional estimate and an understanding of your rights, you can confidently advocate for the full amount you need to make your home whole again.

What to Do When Your Claim Is Underpaid or Denied

It’s a gut punch. You’ve been waiting for weeks, and the email from your insurance company finally arrives with a lowball offer or, even worse, an outright denial of your hail damage roof insurance claim. It's incredibly frustrating, but here in North Texas, it's a story we hear all the time.

Don't panic. This isn't the final word. Think of that initial decision as their opening offer in a negotiation, not a verdict set in stone. You absolutely have the right to challenge their assessment. With a calm, strategic approach, you can fight for the fair settlement you’re owed.

Start by Requesting a Second Opinion

Your very first move should be to formally ask for a second inspection from a different insurance adjuster. It's entirely possible the first adjuster was having a bad day, was buried under a mountain of claims after a big Granbury hailstorm, or simply lacked the experience to spot anything beyond the most obvious damage.

When you make the call or write the email, stay professional but firm. Explain that you believe the initial assessment was incomplete and that you have new evidence to present—which will be the detailed estimate from your trusted local roofer. This simple step changes the dynamic from a complaint to a formal dispute backed by professional documentation.

A common excuse for a denial is "pre-existing damage." The insurer might claim your roof was simply old. This is where a reputable contractor’s report becomes your best defense, as it can systematically show the fresh, specific signs of hail impacts versus normal wear and tear.

Leverage Your Contractor's Detailed Estimate

That estimate from your roofer? It's the most powerful tool you have. It isn't just a number; it's a professional counter-offer that spells out exactly what it will take to properly restore your home according to local building codes.

A strong estimate should include:

Itemized Details: It needs to break down every single cost, from the specific type of shingles and underlayment to labor, ventilation components, and debris removal.

Code Compliance: It should factor in any necessary upgrades to meet current Weatherford or Hood County building codes—something out-of-town adjusters frequently miss.

Photo Evidence: The estimate must be supported by all the photos your contractor took, highlighting the dings, cracks, and bruises the adjuster overlooked.

When you submit this comprehensive package to your insurance company, you shift the burden of proof. Now, it's on them to explain why their assessment is more accurate than that of a hands-on roofing expert who was actually on your roof.

When to Escalate to a Public Adjuster or Attorney

If you've submitted your evidence and are still hitting a brick wall, it might be time to bring in heavier support. Knowing who to call—and when—is critical.

Public Adjuster

A public adjuster is a licensed professional you hire to represent your interests, not the insurance company's. They are experts in policy language, damage documentation, and settlement negotiations.

Best for: Complex or large-loss claims where the fight is over the scope and cost of the damage. Imagine a retiree in Glen Rose with a large, intricate roof system; a public adjuster can be a game-changer.

Cost: They typically work for a percentage of the final settlement, usually around 10%.

Attorney

If you suspect your insurer is acting in bad faith—meaning they are unreasonably delaying your claim, refusing to communicate, or misrepresenting your policy—you may need legal muscle.

Best for: Situations involving clear legal disputes, bad-faith tactics, or if the insurance company is flat-out refusing to honor the terms of your policy.

Cost: This varies, but many work on a contingency fee basis, meaning they only get paid if you win.

Don't underestimate what's at stake. Hail is responsible for a staggering 50-80% of all thunderstorm-related insurance claims and causes an estimated $10 billion in property damage every year in the U.S. You can learn more about the escalating risk of hail damage from Munich Re. With that much money on the line, insurers have a powerful incentive to minimize payouts. That's why you have to be ready to advocate for yourself.

Answering Your North Texas Hail Claim Questions

After a big hailstorm rolls through Granbury, Weatherford, or anywhere else in North Texas, my phone starts ringing with the same questions. It’s understandable. Trying to figure out a hail damage roof insurance claim is confusing, and a lot of bad advice gets passed around. Let's cut through the noise and tackle the most common questions I hear from homeowners.

How Long Do I Have to File a Hail Damage Claim in Texas?

Technically, Texas law generally gives you about a year from the date of the storm to file a claim, but you need to check your specific policy. That said, waiting that long is a terrible idea.

The more time that passes, the easier it is for an insurance company to argue that the damage wasn't from that one specific storm. They might claim it was from a later storm, or just normal wear and tear. The longer you wait, the weaker your case gets. Your best move is always to act fast.

My Insurer Only Wants to Repair My Roof. What Now?

This is probably the biggest fight homeowners face. The adjuster says they'll only pay to replace a few dozen shingles, but your roofer is telling you the whole roof needs to be replaced. This puts you right in the middle of a frustrating and expensive problem.

A "patchwork" repair almost never ends well. Here’s why:

It Looks Terrible: It is nearly impossible to find new shingles that match the color of your existing roof, which has been fading in the Texas sun for years. The result is an ugly checkerboard pattern that tanks your home's curb appeal.

It Voids Your Warranty: Most shingle manufacturers will void the entire roof's warranty if you install mismatched products. That leaves you completely unprotected down the road.

It's Weaker: A patched roof disrupts the integrated system of shingles, creating weak points that are more likely to leak during the next downpour.

A good, local roofer will give you a detailed report explaining exactly why a full replacement is the only responsible way to restore your roof's integrity. You can then hand that professional assessment to your insurance company—it’s powerful proof to back up your claim for a full replacement.

Don't settle for a cosmetic fix that leaves your home vulnerable. A full replacement is often necessary to restore the roof's structural integrity and protect your investment for years to come.

Can I Keep the Leftover Insurance Money?

I hear this one all the time, and it's a very expensive misunderstanding. The short answer is no. If your roofer's final bill comes in under what the insurance company paid, you don't just get to pocket the extra cash.

Most homeowner's policies in Texas are Replacement Cost Value (RCV) policies. First, the insurer sends you a check for the Actual Cash Value (ACV), which is the value of your old roof minus depreciation. The rest of the money, called depreciation, is held back. You only get that second check after you show them a final, paid invoice from your contractor proving the work was done for the full amount they approved. The system is designed to "make you whole," not to let you profit from the claim.

What Are the Best Roofing Materials for North Texas Hail?

If you have to get a new roof, you might as well use the opportunity to upgrade and get something that can stand up to our wild weather. For those of us living in the hail belt, two options really shine.

Class 4 Impact-Resistant Shingles: These shingles are specifically engineered and tested to take a beating from hail. They cost more upfront, but they are significantly tougher. Better yet, installing them can often get you a serious discount—sometimes up to 20-30%—on your annual homeowner's insurance premium.

Metal Roofing: A fantastic choice, especially for families on rural properties or anyone who wants a "one and done" solution. Metal offers incredible durability against hail, high winds, and fire. It’s a long-term investment that provides decades of peace of mind.

Choosing the right material now could save you the headache of going through another hail damage roof insurance claim anytime soon.

Navigating the claims process can be a challenge, but you don't have to do it alone. If you're feeling overwhelmed or just want an expert opinion, the team at Gemini Homes is here to help. We offer free consultations to review your situation and provide clear, honest guidance. Contact us today at https://www.geminihomesgranbury.com.

Comments