A Guide to North Texas Title Escrow Services

- scott shipp

- Dec 1, 2025

- 14 min read

Buying or building a new home is one of life’s biggest moments, but the journey to closing day can bring up a lot of confusing jargon. Two terms you'll hear a lot are title and escrow services. These services are your safety net, designed to protect everyone in the transaction—you, the seller, and the lender—by making sure property ownership is clear and all money is handled securely.

Navigating Title and Escrow in North Texas

When you're buying land or building a home here in Granbury, Weatherford, or Glen Rose, the deal is more than just swapping cash for keys. It's a formal, legal transfer of property rights, and that’s precisely where title and escrow professionals come in. Although the same company often handles both, they are two distinct services that work hand-in-hand to ensure a smooth closing.

The Two Pillars of a Secure Closing

The closing process is built on two core functions. Once you understand their individual roles, the whole thing becomes much clearer.

Title Services: This is the detective work. A title company digs into the property's history to verify that the seller has the legal right to sell it. They hunt for hidden problems like old debts (liens), property line arguments, or even long-lost heirs who might have a claim to your new home.

Escrow Services: This is the coordination and administration. An escrow officer is a neutral third party who holds all the important items—money, legal documents, and instructions from all parties. They don't let a dollar change hands or file the new deed until every condition in the sales contract is met.

It helps to think of your escrow officer as the referee of the transaction. Their job is to make sure everyone plays by the rules so the final outcome is fair. For example, say you're building on a piece of land outside of Stephenville. A thorough title search might uncover an old, forgotten utility easement running right where you planned to put the driveway. The title company works to clear that up before you close, saving you from a major headache later.

At the end of the day, title and escrow give everyone peace of mind. They turn a complicated legal process into a clear, predictable set of steps, so you can be confident that your investment in a new North Texas home is safe from the very beginning.

This guide will walk you through exactly what these services do, what to expect, and why they are essential for protecting your family’s investment, whether you're building a custom home from the ground up or buying an existing property.

Understanding the Roles of Title and Escrow

When buying or building a home, you'll hear "title" and "escrow" constantly. They’re often mentioned together, and for good reason—the same company usually handles both. But they are two distinct services, each playing a critical role in protecting your investment. Think of them as two specialists on your closing team: one is a historian and detective, the other a neutral referee.

First, let's talk about title. A property title is the legal proof that you are the rightful owner. It’s the official document that grants you all the rights that come with ownership—the right to live on, change, and eventually sell your property.

Escrow, on the other hand, is a process, not a document. It’s a secure holding account managed by a neutral third party called an escrow officer. This account is like a financial safe deposit box where all the money, the deed, and other crucial documents are held until every last condition in the purchase agreement has been met by both the buyer and the seller.

The Title Company: Your Property Detective

The title side of the business digs into the past. Their main job is to conduct a deep, historical investigation of the property you’re buying. They sift through decades of public records to make sure the property has a “clear title.” A clear title means the person selling the property has the undisputed right to do so and that once you own it, no one else can show up with a valid claim.

This investigative work stands between you and a future property dispute. Imagine discovering years after building your dream home in Granbury that a previous owner's unresolved lien gives a creditor a claim to your land. A thorough title search prevents that nightmare scenario.

Title professionals are on the hunt for specific issues, often called "clouds" or "defects," that could threaten your ownership. Common problems include:

Unpaid Property Taxes or Liens: This could be anything from the previous owner's unpaid taxes to a contractor who wasn't paid for a long-ago project.

Undisclosed Heirs: A search might turn up a forgotten relative of a past owner who technically has a legal claim to a piece of the property.

Boundary Disputes or Easements: A survey might reveal that a neighbor’s fence is on your land, or that an old utility easement gives a company access rights to part of your rural property near Glen Rose.

Forgeries or Filing Errors: You'd be surprised how often simple clerical mistakes or even fraudulent signatures in old deeds can create massive ownership headaches.

When the title company finds these problems, they work to get them resolved long before you sign the final paperwork.

The Escrow Officer: Your Neutral Coordinator

While the title team focuses on the property's history, the escrow officer is the impartial manager of the current transaction. They follow the instructions in your purchase contract to the letter, ensuring everything happens fairly and in the right order. Their loyalty is to the integrity of the deal itself, not to the buyer or seller.

This industry is a cornerstone of the real estate market. The title and settlement services sector in the United States includes about 6,910 companies and has grown into a major industry. Its health is directly tied to the housing market, showing how essential these services are. You can dig into more data by exploring the full title and settlement services industry report.

Here's what an escrow officer typically handles:

Holding your earnest money deposit in a secure account.

Coordinating with your lender to receive loan documents and funding.

Ensuring all paperwork—from the deed to loan agreements—is signed correctly by everyone.

Using sale proceeds to pay off the seller's existing mortgages or any liens against the property.

Once all conditions are met, they officially record the new deed with the county (making you the legal owner!) and distribute the money to the right parties.

By understanding these two connected roles, you can see how title escrow services create a complete safety net for your home purchase here in North Texas.

How Escrow Works For New Home Construction

If you're buying a pre-owned home, the escrow process is a fairly straightforward, one-time event. But when you’re building a brand new home in North Texas, it’s a different ballgame. Instead of a single money transfer at closing, funds for your build are managed and paid out in stages. This system is designed to protect both you and your builder from start to finish.

The engine that drives new construction escrow is the draw schedule. This is a detailed payment plan, agreed upon by everyone, that ties payments to specific construction milestones. Think of it as a transparent financial roadmap for your project. Your escrow officer releases funds bit by bit as the work gets done and passes inspection.

This step-by-step process offers serious protection. It guarantees your builder has the capital they need to buy materials and pay their crew on time, keeping your project on track. For you, it provides peace of mind that you're only paying for work that has actually been completed to the agreed-upon standard.

The Draw Schedule In Action

A draw schedule for a Gemini Homes custom build in Weatherford or a major remodel in Granbury is incredibly detailed. Each payment, or "draw," is linked to a tangible phase of construction. Here’s a simplified breakdown of how it typically works:

Initial Draw: Covers upfront costs like permits, site prep, and initial material orders.

Foundation Poured: Once the foundation is complete and passes inspection, the builder can request the next draw.

Framing Complete: After the skeleton of your home is up—walls framed, roof decking on—another draw is disbursed.

Dry-In Stage: This milestone is hit once windows, doors, and roofing are installed, making the structure weather-tight.

Systems Rough-In: This covers plumbing, electrical wiring, and HVAC systems before drywall is installed.

Interior Finishes: Draws continue for major interior work like drywall, flooring, and cabinet installation.

Final Draw: The last payment is held until the home is 100% finished, a Certificate of Occupancy has been issued, and you’ve completed a final walkthrough.

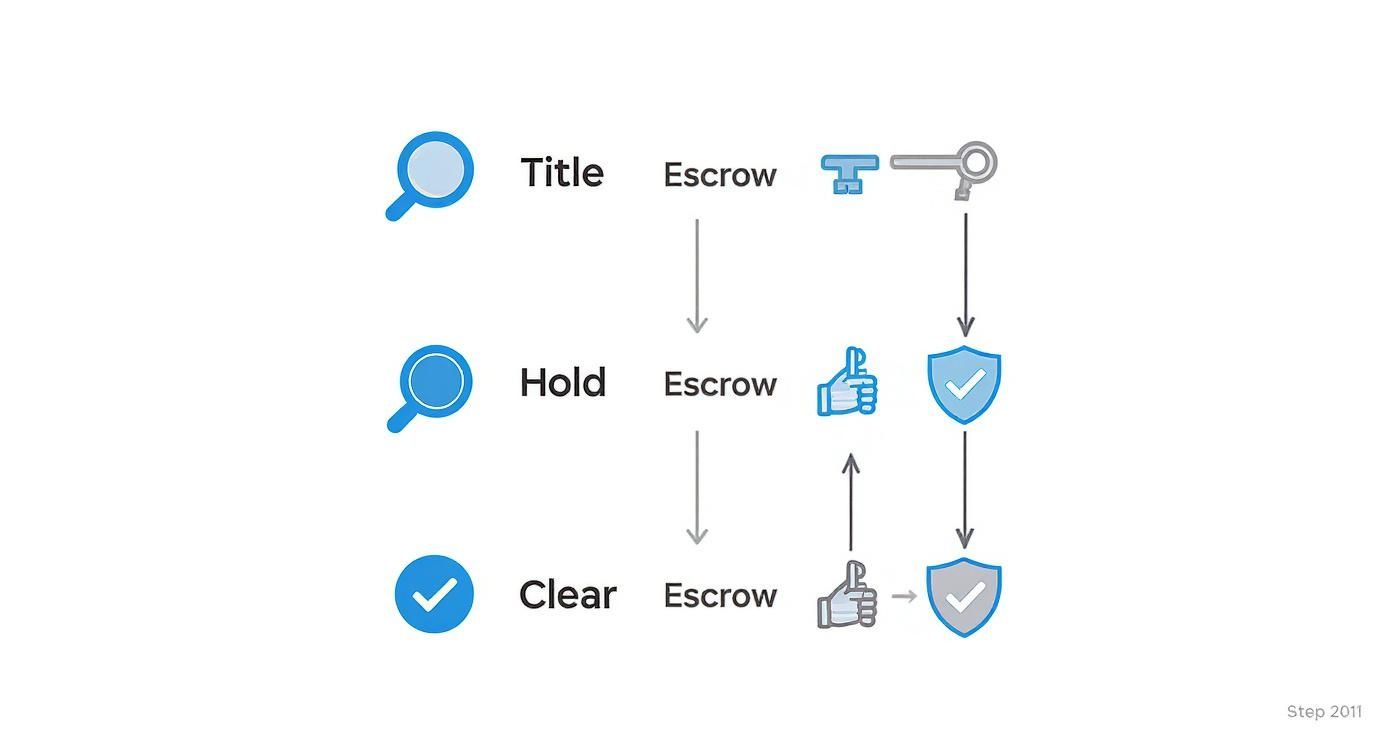

This flowchart gives a great visual of how the title and escrow processes work hand-in-hand to make sure every detail is researched, secured, and cleared for a smooth transaction.

Typical New Construction Escrow Timeline in North Texas

Construction Phase | Key Milestone | Escrow Action |

|---|---|---|

Pre-Construction | Permits Secured & Site Prep | Release initial draw for mobilization. |

Foundation | Foundation Poured & Cured | Verify inspection; release foundation draw. |

Framing & Dry-In | Frame, Roof, Windows Installed | Verify progress; release framing draw. |

Rough-In | Plumbing, Electrical, HVAC Done | Verify inspections; release MEP draw. |

Interior Finishes | Drywall, Paint, Cabinets, Flooring | Release draws as major finishes are completed. |

Final Stages | Final Inspections Passed | Hold final funds pending final approval. |

Completion | Certificate of Occupancy Issued | Disburse final payment to builder after C.O. |

The Importance Of Lien Waivers

Throughout the build, your general contractor hires subcontractors—plumbers, electricians, roofers, and more. A critical job for the escrow officer is managing lien waivers.

Think of a lien waiver as an official receipt. It's a document signed by a subcontractor or supplier confirming they’ve been paid in full for their work and are giving up their right to place a "mechanic's lien" on your property.

Your escrow officer will require these signed waivers with each draw request before releasing the next round of funding. This is a non-negotiable step that prevents a subcontractor from showing up months later claiming they were never paid, which could put a nasty legal cloud over your new home's title. This is one of the most important protections you get from using a professional title and escrow company for your build.

It’s also crucial to coordinate the draw schedule with your lender’s appraisals, since the bank will often send its own inspector to confirm progress before they release loan funds. To get a better handle on this, check out our Texas Guide to New Construction Appraisals.

Why Owner's Title Insurance Is So Important

Buying a home is the single biggest investment most people will ever make. To get your loan, the bank will insist you buy a Lender’s Title Insurance policy to protect their financial stake in the property.

But there's another policy that’s all about protecting you: Owner's Title Insurance. While it’s technically optional, skipping it is a gamble I’d never recommend. It's the critical safeguard for your family’s equity and future peace of mind. A lender's policy only covers the bank's loan amount. An owner's policy protects your entire investment for as long as you or your heirs own the property. It's a one-time premium you pay at closing that defends you against skeletons that might be hiding in the property's closet.

A Real-World Example from North Texas

Imagine a family finds a beautiful piece of land in Glen Rose to build their forever home. They go through closing and spend the next five years pouring their heart and soul into creating their dream property. Then one day, a certified letter arrives from an attorney. It turns out the original owner from decades ago passed away without a proper will. A previously unknown heir has surfaced with a valid legal claim to a piece of their land. Suddenly, this family is facing a costly legal battle to defend their ownership, with a very real chance of losing their home.

This is exactly what owner's title insurance is for. Without it, that Glen Rose family would have to hire attorneys and could end up paying a claim that could easily hit tens or even hundreds of thousands of dollars. With an owner's policy, the title company steps in to manage the entire legal defense and cover any financial losses.

Owner's title insurance is your shield against the past. It protects you from human errors and hidden issues that a standard title search might not uncover, ensuring that a problem from 50 years ago doesn't become your financial crisis today.

Common Threats Owner's Title Insurance Protects Against

The title search is incredibly thorough, but it's not a crystal ball. There are certain "hidden hazards" that can pop up years after you’ve moved in. An owner's policy is designed to protect you from these risks.

Undisclosed Heirs: Just like in our Glen Rose story, a long-lost relative of a previous owner could emerge with a legitimate claim.

Forgeries and Fraud: Someone could have forged a signature on a deed years ago, making a past transfer illegal and putting a cloud over your title.

Filing Errors: Simple clerical mistakes at the county recorder's office can create serious ownership disputes down the line.

Unpaid Liens: A prior owner might have failed to pay a contractor or a tax bill. That lien could resurface and attach to your property, making you responsible.

The title insurance market, a key component of title escrow services, is expected to grow from $4.15 billion in 2025 to $5.69 billion by 2034. The owner's policy segment alone was valued at $1.5 billion in 2023, showing how many homeowners depend on it to secure their investment. You can find more details about this growing market on HousingWire.com.

Choosing to buy owner's title insurance isn't just another closing cost—it's a permanent safeguard for your most valuable asset.

What Will Title and Escrow Cost Me in Texas?

Let's talk numbers. Understanding what you'll likely pay for title escrow services is one of the best ways to prepare for a smooth home-building journey.

Here’s some good news if you're building or buying in Granbury, Aledo, or anywhere else in North Texas: a big chunk of these costs is regulated. The Texas Department of Insurance (TDI) sets the rates for title insurance policies. This means you won't find a "cheaper" policy by shopping around—the state mandates the premium to ensure fairness. That said, other service fees can vary between companies.

Common Title and Escrow Charges

Your lender will give you an official Loan Estimate, but here are the specific fees related to the title and escrow work.

Owner’s Title Insurance Premium: A one-time fee paid at closing that protects your ownership rights for as long as you or your heirs own the property.

Lender’s Title Insurance Premium: Required by most lenders, this separate policy protects their investment—the loan amount—against title defects.

Escrow or Settlement Fee: This covers the cost of your escrow officer acting as the neutral third party who juggles documents, manages money, and ensures the closing happens correctly.

Title Search Fee: This pays for the behind-the-scenes detective work of digging through county records to verify the property's legal history.

Recording Fees: Once signed, the new deed and mortgage have to be officially filed with the county clerk (in Hood, Parker, or Somervell County, for example). This fee covers the county's charge to make your ownership a matter of public record.

Estimated Costs for a North Texas Home

To give you a real-world idea of what to budget for, let's look at some typical costs for a home in the $400,000 range. These are solid estimates, but your final figures will be on your official closing documents.

Estimated Title and Escrow Costs for a $400,000 Texas Home

Fee Item | Typical Cost Range (Texas) | Who Typically Pays (Buyer/Seller) |

|---|---|---|

Owner's Title Insurance | $2,100 - $2,300 | Negotiable, often the Seller |

Lender's Title Insurance | $100 (if bought with Owner's) | Buyer |

Escrow / Settlement Fee | $350 - $600 | Typically split 50/50 |

Title Search Fee | $200 - $400 | Buyer |

Recording Fees | $150 - $250 | Buyer |

The final numbers can shift based on the deal. A property with a complicated ownership past might need a more intensive title search. Building on a large rural lot in Parker County might involve more complex survey work, which also plays a role. You can get a deeper look into these details in our complete guide on how to build a custom home in North Texas.

The ultimate goal of these fees isn't just to close a transaction—it's to purchase certainty. You are paying for the assurance that your new home is truly yours, free from past claims or hidden issues.

Always take the time to review your closing documents with your title officer and builder. Never be afraid to ask, "What is this charge for?" A great team will walk you through every line item until you feel completely comfortable.

Your Final Home Closing Checklist

Closing day is the moment it all becomes real. After all the decisions and anticipation, you’re just a few signatures away from holding the keys to your brand-new North Texas home. To make sure that final step is as smooth as possible, it helps to have a pre-closing game plan.

Three To Five Days Before Closing

Carefully review your Closing Disclosure (CD). This is a critical five-page document that lays out the final, exact numbers for your home loan and the entire transaction. By law, your lender must provide this to you at least three business days before you sign anything. Compare it to the Loan Estimate you received at the beginning. If any fees or terms look different than expected, ask your lender and title officer right away.

The Day Before Closing

With the numbers confirmed, it’s time to focus on the home itself and getting your funds ready.

Schedule Your Final Walkthrough: This is a big one, especially with a new build in Granbury or Weatherford. You'll walk through the property with your project manager, making sure every last detail has been finished to your satisfaction. You can learn more about this in our homeowner's guide to the construction timeline.

Arrange Your Funds: You can’t bring a personal check to closing. You'll need a cashier’s check from your bank or to set up a wire transfer. Double-check the final amount with your title company. If you're wiring money, get their official, secure instructions and be very cautious about any last-minute changes (scammers often target this).

Gather Your Documents: Find your valid, government-issued photo ID, like a driver’s license or passport. Make sure everyone signing the documents has theirs ready.

The Day Of Closing

You've done the prep work, so today should be the easy part. Just remember to bring your essentials: your photo ID, the cashier's check (if not wiring funds), and any other paperwork your title company specifically requested.

Closing on a home is a huge milestone. Being prepared lets you focus on the excitement of the moment instead of the stress of the transaction. It should feel like a celebration, and with these final items checked off, you can sign with total confidence.

Common Questions We Hear About Title and Escrow

It’s completely normal to have a few more questions pop up. The world of title and escrow services has its own jargon, and getting clear, straightforward answers makes a world of difference. Here are a few frequent questions we get from clients building homes in Granbury, Weatherford, and the rest of North Texas.

How Do I Choose a Title Company?

When you’re looking for a title company around here, local experience and reputation are everything. Your builder or real estate agent usually has a shortlist of trusted partners. Ask them how they like to communicate, what their fees typically look like, and how much new construction work they’ve handled. Properties in more rural areas like Parker or Somervell County can have unique title histories, so a company that knows the local landscape is a massive advantage.

What Happens If a Problem Is Found During the Title Search?

Finding a "cloud" on the title sounds scary, but it rarely means the deal is off. This could be an old unpaid tax bill, a contractor's lien, or a boundary line dispute. In reality, this is why you have a professional title search done. The title company’s job is to work with the seller to resolve these issues before you ever sign. This process is called "clearing the title." It might add a little time, but the vast majority of these problems can be fixed, preventing you from inheriting someone else’s mess.

Finding a title issue isn’t a red flag to stop the deal; it’s proof that the system is working. It’s the title company doing its job to protect your investment before a past problem can become a future headache.

Can I Use the Same Escrow for My Construction Loan and Permanent Mortgage?

Yes, absolutely. This is not only possible but also a common and more efficient way to do things, often called a "construction-to-permanent" loan closing. The title company can set up a single, streamlined closing where your construction loan is put in place, and the terms for converting it into a standard mortgage are all finalized at once. This saves time and can even cut down on closing costs because you aren't doing two completely separate transactions.

Juggling the details of a new home build can feel overwhelming, but you're not in it alone. At Gemini Homes, we work alongside you and the best local title professionals to make sure your project is secure from day one.

If you’re ready to talk about your vision for a new home in North Texas, let's start the conversation.

Comments